Bootstrapping vs. Fundraising: The Ultimate List to Pros and Cons

October 21, 2024 2024-01-16 13:29Bootstrapping and fundraising are two distinct approaches to financing a business. Bootstrapping involves self-funding your venture using personal savings or revenue the business generates. It’s like building from the ground up, relying on internal resources without external financial support. While bootstrapping offers autonomy and avoids debt, it may limit rapid expansion due to resource constraints.

On the other hand, fundraising involves seeking external capital from investors, venture capitalists, or crowdfunding. This approach provides access to more substantial funds to fuel faster growth and innovation. However, it often requires giving up equity or taking on debt, which may reduce ownership control.

Bootstrapping suits entrepreneurs looking for independence and steady growth, while fundraising is suitable for those aiming for rapid expansion but willing to share ownership. Each method has pros and cons, and the choice depends on the business’s goals, risk tolerance, and growth strategy.

Fundamentals of BootStrapping

Bootstrapping is a smart way for people to start and grow a business without needing a lot of outside money. Instead of relying on big investments or loans, entrepreneurs use their own savings and the money the business makes to run and expand. This method encourages independence and self-sufficiency.

Bootstrapping means being really careful with money and making the most of what you have. Entrepreneurs often start small, focusing on the most important things and putting the money they make back into the business.

Bootstrapping isn’t just about money—it’s also about being creative and resilient. Entrepreneurs have to find smart solutions, spend money wisely, and handle challenges. Even though it takes time and planning, bootstrapping can make a business strong from the beginning, growing on its own without getting into a lot of debt. Overall, bootstrapping helps entrepreneurs build successful businesses that can stand on their own.

Fundamentals of Fundraising

Fundraising is the proactive effort to garner financial support for a specific cause, organization, or project, involving outreach to individuals, businesses, and other entities to secure donations. At its core, successful fundraising hinges on effective communication, relationship building, and showcasing the tangible impact of the cause.

Articulating the purpose and goals of the initiative is pivotal, necessitating the creation of a compelling narrative that resonates with potential donors. Establishing trust is paramount; transparency regarding the utilization of funds fosters confidence and credibility. Diversification of fundraising strategies is prudent to mitigate risks associated with dependence on a single source.

Common methods encompass events, online campaigns, grant applications, and forging corporate partnerships. Regular expressions of gratitude to donors serve to reinforce their support, fostering a sense of appreciation that encourages ongoing contributions. Maintaining open lines of communication ensures donors remain informed about the tangible impact of their contributions, fostering a lasting and mutually beneficial relationship.

Bootstrapping Pros and Cons

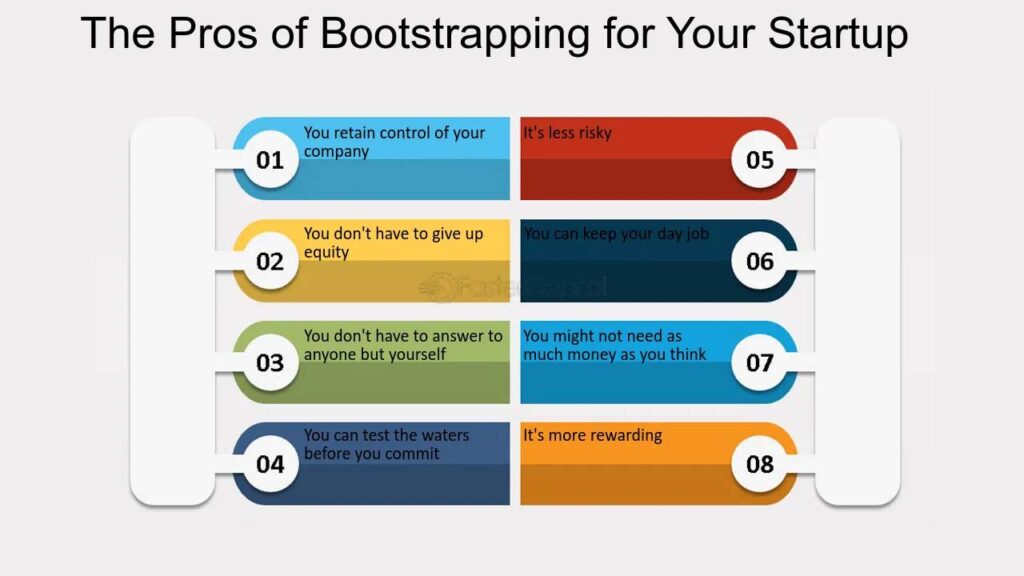

Bootstrapping Pros:

Here are some of the bootstrapping pros you must know in detail:

Autonomy and Control

One of the key advantages of bootstrapping is the autonomy and control it affords to entrepreneurs. When a business is self-funded, founders retain complete control over decision-making and strategic direction without external investors influencing the company’s trajectory. This autonomy allows for quick pivots and adjustments based on market feedback, enabling entrepreneurs to stay true to their vision.

Unlike businesses relying on external funding, bootstrapped ventures are not beholden to investors’ demands, fostering a more agile and independent operational environment. This control proves invaluable in navigating challenges and adapting to market dynamics, as entrepreneurs can make swift decisions aligned with their long-term goals.

Financial Discipline

Bootstrapping instills a high level of financial discipline in entrepreneurs. Without the cushion of external funding, founders are compelled to manage resources judiciously, fostering a lean and efficient operational model. This financial prudence extends to all aspects of the business, from daily expenditures to strategic investments. Entrepreneurs are forced to prioritize essential expenses, eliminate unnecessary overhead, and seek cost-effective solutions.

This disciplined approach not only enhances the company’s survival chances during lean periods but also cultivates a culture of fiscal responsibility. As the business grows, this financial discipline becomes ingrained in its DNA, promoting sustainable growth and resilience. Ultimately, bootstrapping encourages a mindset that values efficiency, resourcefulness, and long-term financial sustainability.

Stress-Free Debt

Bootstrapping liberates entrepreneurs from the burden of external debt. Unlike businesses relying on loans or credit lines, bootstrapped ventures operate without the looming pressure of repayment schedules or interest obligations. This absence of financial liabilities reduces stress and allows founders to concentrate on building and growing their businesses organically.

Without the constant worry of servicing debt, entrepreneurs can make decisions based on the long-term health of the company rather than short-term financial constraints. This stress-free financial environment contributes to a more positive and focused mindset, enabling founders to channel their energy into strategic planning and execution.

Focused Vision

Bootstrapping encourages a focused vision by aligning the company’s goals with available resources. Since bootstrapped businesses operate within tight financial constraints, founders must prioritize initiatives that directly contribute to the core vision and objectives. This focus is crucial for survival and growth, as it prevents the dilution of efforts across multiple fronts.

By concentrating on what truly matters, entrepreneurs can develop a clearer and more compelling vision for their company, one that resonates with customers and stakeholders. This focused vision not only enhances brand identity but also facilitates more efficient resource allocation, ensuring that every action aligns with the overarching strategic goals of the business.

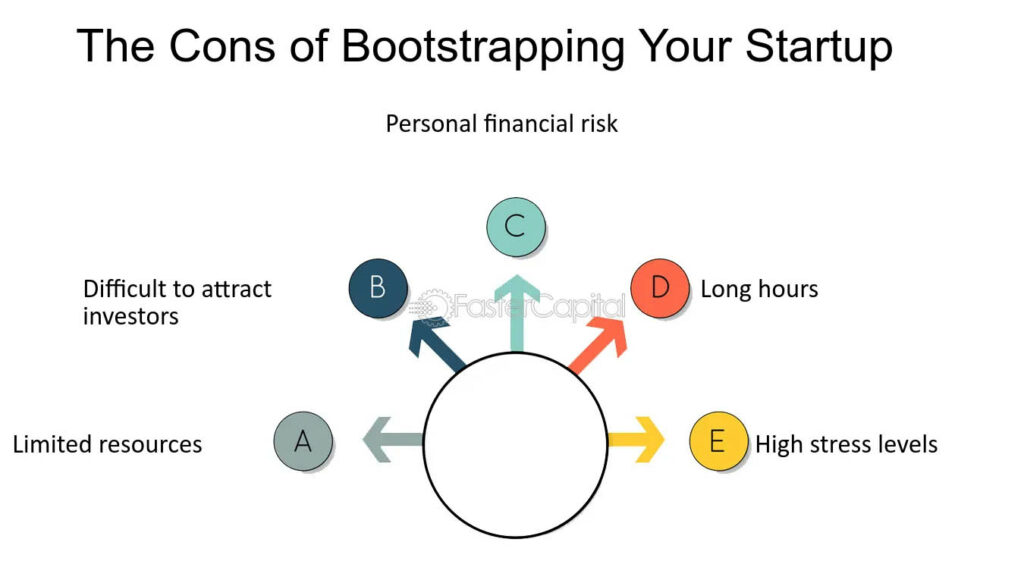

Bootstrapping Cons:

Here are some of the bootstrapping cons you must know in detail:

Limited Resources

Bootstrapping, while cost-effective, is often constrained by limited resources. Entrepreneurs relying on self-funding may face challenges in accessing sufficient capital to scale their operations. Limited financial resources can hinder the ability to invest in critical areas such as marketing, research and development, and talent acquisition.

This constraint may impede the business’s ability to seize timely opportunities, compete effectively, or weather unexpected challenges. Additionally, without external funding, entrepreneurs might struggle to build robust infrastructures, hindering their capacity to innovate and adapt to changing market dynamics.

Risk of Burnout

Bootstrapping often entails a higher risk of burnout for entrepreneurs. Limited financial resources may force founders to take on multiple roles within the company, from operations to marketing, leading to increased workload and stress.

The constant need to wear multiple hats and handle various responsibilities can lead to exhaustion, impacting both physical and mental well-being. Burnout not only affects the founder’s health but can also have detrimental effects on the business, as fatigue may hinder decision-making and overall productivity.

Competitive Disadvantage

Bootstrapped businesses may face a competitive disadvantage compared to their counterparts with external funding. Competitors with access to significant capital can invest in aggressive marketing strategies, product development, and talent acquisition, allowing them to rapidly innovate and expand.

In contrast, bootstrapped ventures may struggle to keep pace, potentially losing market share or being outpaced by well-funded competitors. This competitive disadvantage can make it challenging for bootstrapped businesses to establish a strong market presence, differentiate themselves, or respond swiftly to industry changes, putting them at a strategic disadvantage in the long run.

Dependency on Personal Finances

Bootstrapping often involves a significant dependency on the personal finances of the founders. Entrepreneurs may use personal savings, credit cards, or loans to fund the initial stages of the business. This financial reliance can expose founders to heightened personal financial risks and strains, especially if the business faces unforeseen challenges or takes longer to turn a profit.

The intertwining of personal and business finances can make it difficult to maintain a clear financial boundary, increasing the potential impact on personal credit and assets. Moreover, if the business does not perform as expected, founders may find themselves in a precarious financial situation, jeopardizing their financial stability and well-being.

Fundraising Pros and Cons

Fundraising Pros:

Access to Capital

One of the primary advantages of fundraising is the access to capital it provides. Through various funding channels such as venture capital, angel investors, or crowdfunding, businesses can secure the financial resources needed for operations, expansion, and innovation.

This influx of capital enables entrepreneurs to invest in key areas like product development, marketing, and talent acquisition, fostering the growth and sustainability of the business.

Accelerated Growth

Fundraising can facilitate accelerated growth by injecting substantial capital into the business. With a solid financial foundation, companies can scale operations, enter new markets, and pursue strategic opportunities more rapidly than if they relied solely on organic revenue.

This accelerated growth trajectory can enhance the company’s competitiveness, market share, and overall valuation, providing a strategic advantage in dynamic and competitive industries.

Networking Opportunities

Beyond capital, fundraising often opens doors to valuable networking opportunities. Engaging with investors introduces entrepreneurs to a network of experienced professionals, mentors, and industry connections.

This network can offer guidance, expertise, and potential partnerships that extend beyond the financial aspect of fundraising. The relationships formed during the fundraising process can contribute to the long-term success of the business by providing access to insights, resources, and collaborative opportunities.

Risk Mitigation

Fundraising can act as a risk mitigation strategy by diversifying the sources of capital. Relying solely on personal savings or bootstrapping exposes businesses to greater financial risk, especially during economic downturns or unforeseen challenges.

By securing funding from a variety of investors or funding channels, businesses can distribute the risk and ensure a more stable financial position. Additionally, investors may bring strategic guidance and industry expertise, further enhancing the business’s ability to navigate challenges and mitigate risks effectively.

Fundraising cons:

Dilution of Ownership

One significant drawback of fundraising is the dilution of ownership that occurs when external investors acquire a stake in the company. As entrepreneurs secure funding, they often exchange equity for capital, leading to a reduction in their ownership percentage.

This dilution means that founders have a smaller share of the company, potentially diminishing their control over strategic decisions and the overall direction of the business. While fundraising is essential for growth, founders must carefully weigh the trade-off between capital infusion and the loss of ownership and control.

Pressure to Perform

Fundraising places added pressure on entrepreneurs to meet investor expectations and deliver strong performance. Investors typically seek a return on their investment, often with specified timelines and growth targets.

This pressure can create a challenging environment for founders, leading to heightened stress and a focus on short-term results. The constant need to meet investor expectations may impact long-term strategic planning and hinder the ability to make decisions that prioritize sustainable growth over immediate gains.

Loss of Autonomy

Fundraising can result in a loss of autonomy for entrepreneurs as external investors, such as venture capitalists, may seek a more active role in decision-making. Investors often want a say in major strategic choices to protect their investment and ensure a favorable exit.

This increased involvement can limit the founder’s ability to make independent decisions, potentially conflicting with their original vision for the company. Balancing the input of investors with maintaining the founder’s vision and values becomes a delicate challenge in the fundraising process.

Time-Consuming Process

Fundraising is a time-consuming process that demands significant effort from entrepreneurs. Seeking investors, preparing pitch materials, negotiating terms, and undergoing due diligence can divert valuable time and attention away from day-to-day operations.

The prolonged fundraising process may delay critical business initiatives and hinder the company’s ability to respond quickly to market opportunities or challenges. Additionally, the time spent on fundraising can be unpredictable, with no guarantee of success, further exacerbating the challenge of managing competing priorities and maintaining operational efficiency.

Bootstrapping vs. Fundraising: The Difference

| Aspect | Bootstrapping | Fundraising |

| Autonomy and Control | High control over decision-making and strategic direction | Dilution of ownership; potential loss of control |

| Financial Discipline | Instills financial discipline; lean operational model | Access to substantial capital for growth initiatives |

| Stress-Free Debt | No external debt; stress-free financial environment | Potential pressure to meet investor expectations |

| Focused Vision | Aligns goals with available resources; efficient focus | Accelerated growth may lead to short-term focus |

| Limited Resources | Constraints on accessing capital; challenges in scaling | Access to capital for scaling; rapid expansion possible |

| Risk of Burnout | Higher risk due to multiple roles; increased workload | Pressure to meet investor expectations; potential stress |

| Competitive Disadvantage | May face a competitive disadvantage due to limited funds | Accelerated growth can lead to a competitive advantage |

| Dependency on Personal Finances | Reliance on personal savings; potential financial risks | Diversified sources of capital; risk mitigation |

| Access to Capital | Limited access to external capital; self-reliant | Substantial capital infusion for operations and growth |

| Accelerated Growth | Limited growth rate; organic expansion | Rapid expansion and market entry with significant funds |

| Networking Opportunities | Limited networking opportunities; self-driven growth | Access to valuable networks, mentorship, and partnerships |

| Risk Mitigation | Higher financial risk; self-reliance | Diversification of capital sources; risk mitigation |

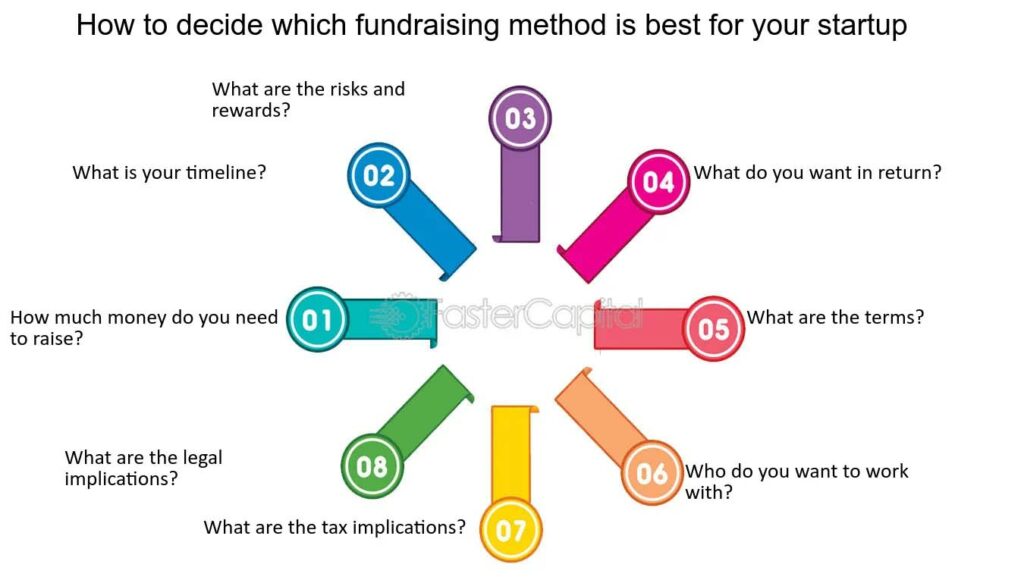

Final Thoughts

Bootstrapping involves self-funding a business, relying on personal savings or revenue, offering independence but limiting growth. Fundraising secures external capital, enabling rapid expansion but sacrificing control and equity. Bootstrapping suits those valuing autonomy and minimizing debt, while fundraising is ideal for ambitious ventures needing substantial resources. Ultimately, the choice depends on the entrepreneur’s goals, risk tolerance, and the nature of their business.