Pre-Seed vs. Seed Funding: Which is Right for Your Startup

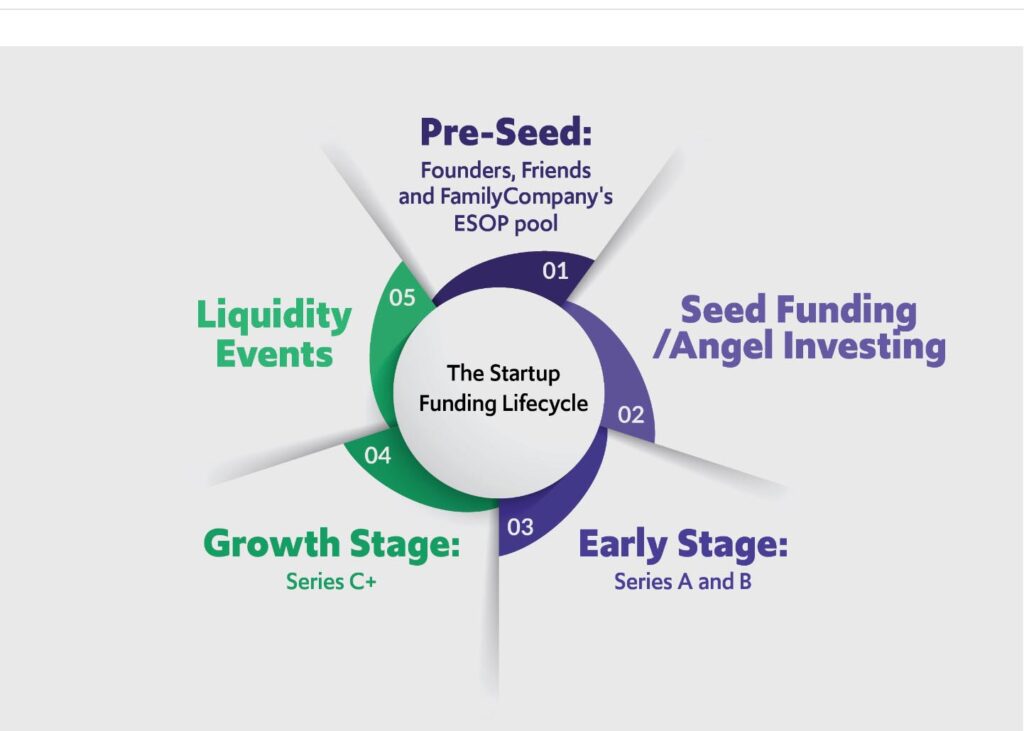

August 12, 2024 2024-01-13 15:22Pre-Seed and Seed Funding are crucial stages in a startup’s journey, each serving distinct purposes. Pre-seed funding typically occurs in the initial phase, where entrepreneurs use personal savings or funds from friends and family to develop a concept or create a prototype. This stage focuses on idea validation and market research, preparing the groundwork for future investment.

Seed Funding follows, representing the first formal fundraising round from external investors. At this point, startups aim to refine their product, expand their team, and gain traction in the market. Investors, often angel investors or early-stage venture capitalists, provide capital in exchange for equity.

Pre-Seed Funding is about getting started, often with personal resources, while Seed Funding is the first external injection of capital to scale and grow. Both stages are critical for transforming an idea into a viable business, paving the way for subsequent funding rounds as the startup evolves.

Benefits of Pre-seed Funding and How it Works?

Pre-seed funding is essential for early-stage startups because it gives them the money they need to turn their creative ideas into businesses that can make money. The main benefit is that it gives owners the money to improve their ideas, make prototypes, and do preliminary market research. At this time, angel investors, friends, or family usually give smaller amounts of money.

The first step is for entrepreneurs to show possible investors their business ideas and explain their goals and plans for growth. Investors, who are usually experienced business owners or people who know a lot about the industry, look at the possibilities of the business and the founders’ skills. Startups can get pre-seed funding, like trying the market and making new products, to cover their first costs. This makes it possible for them to raise more money in later rounds.

Pre-seed funding gets entrepreneurs off the ground by giving them the tools they need to get through the tough early stages of business development and turn their creative ideas into real, marketable products.

How does seed funding for startups work

Seed funding is the initial capital provided to startups to help them take their first steps. It’s like planting a seed for a future business to grow. Typically, entrepreneurs seek seed funding to develop their business idea, create a prototype, or conduct initial market research. Investors, often individuals or angel investors, provide this funding in exchange for equity in the startup.

The amount can vary but is generally smaller compared to later funding rounds. Startups use seed funds to cover early expenses such as product development, hiring key team members, and marketing. In return, investors hope the startup will succeed, and their initial investment will grow along with its valuation.

Seed funding is crucial as it gives startups the financial boost needed to prove their concept and attract further investment in later stages. It’s a pivotal stage in the startup journey, aligning resources with potential and paving the way for future growth and success.

Top 8 Key Differences between Pre-Seed Funding and Seed Funding

“Unlock the details: Pre-Seed vs. Seed Funding differences explained. Essential insights for startup success and strategic financial planning.”

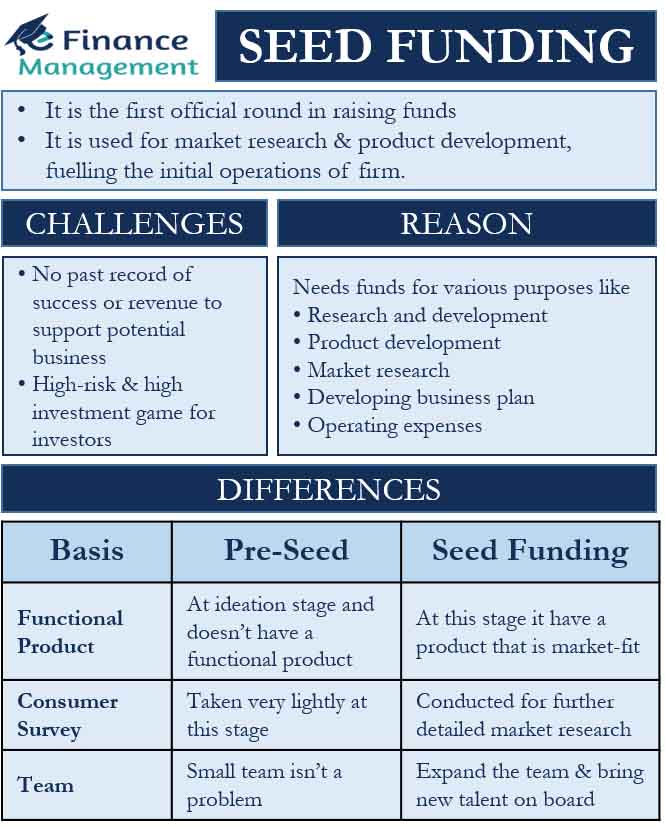

Stage of Funding

The steps of funding are essential in making a business idea come true. Pre-seed funding is given right at the start, when an idea is just starting to take shape, and often before a prototype exists.

In this stage, founders look for small amounts of money, generally from their own savings or from family and friends, to test their ideas and build a basic model. Seed funding, conversely, comes in when a business has a product or service that works. Angel investors, venture capitalists, or early-stage funds may put money into the business now, which is more substantial.

Seed funding is essential for growing business, marketing, and finding a better fit with the market. Entrepreneurs need to know about these stages because they help them find funding, get the right tools at the right time, and move their businesses forward.

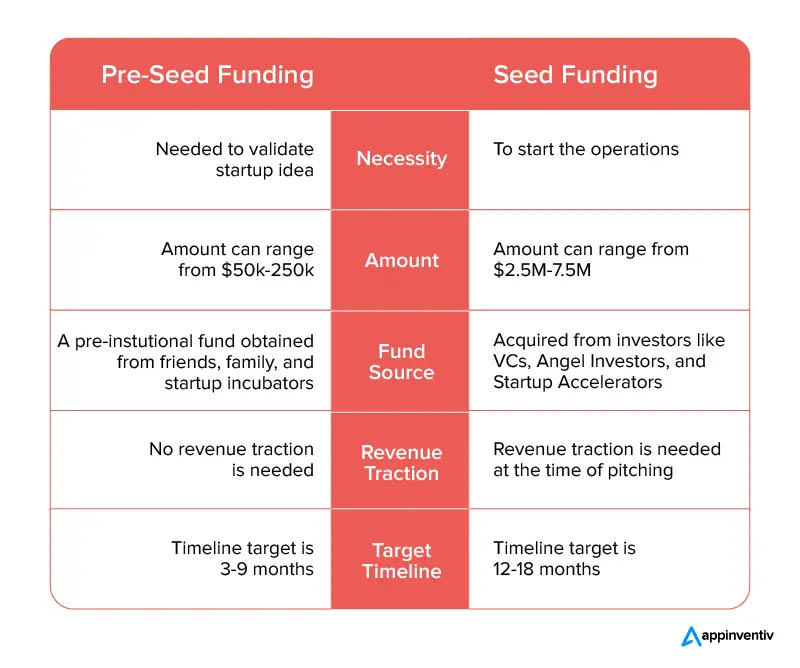

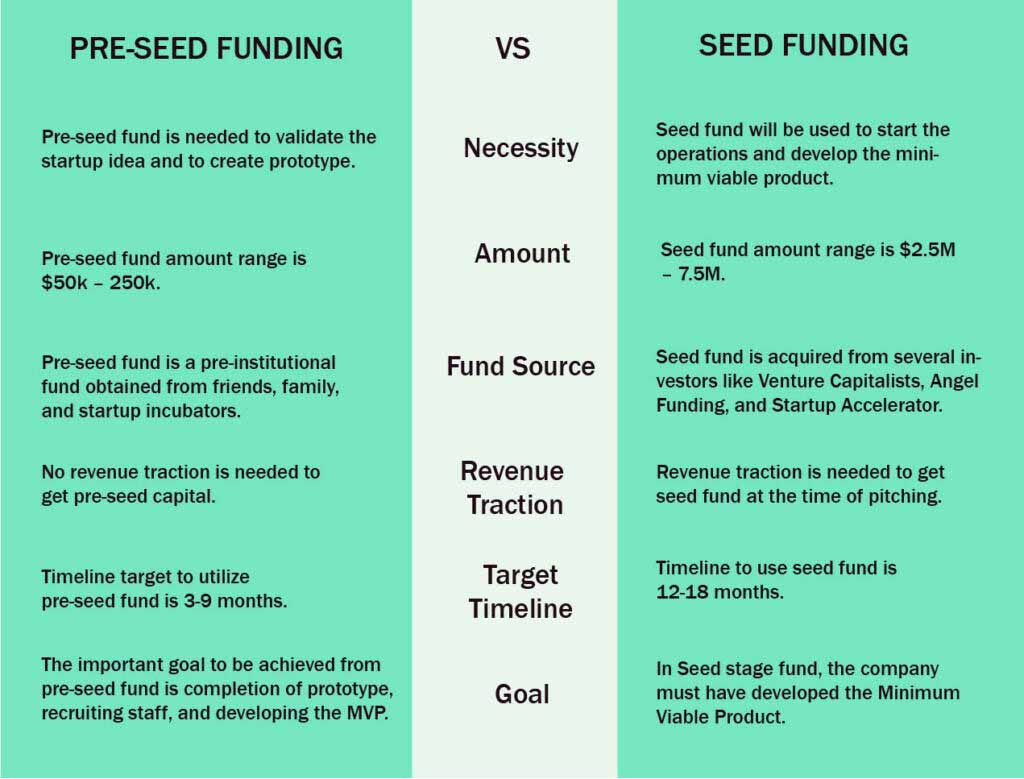

Investment Size

Pre-seed funding and seed funding are two types of startup funding. The main difference between them is the size of the payment. In the pre-seed stage, investments are usually smaller, and the main goal is to test the business idea or make the prototype.

During this stage, founders, friends, or family who believe in the idea’s promise often give money or other resources. The investment size increases significantly when a company reaches the seed funding stage. Seed funding is for companies with a product or service that works and wants to grow, market more, and find the right customers.

Angel investors, venture capitalists, or early-stage funds often give this much money. Entrepreneurs looking for funding need to know the difference between these two terms to match their funding needs with the right stage of business growth.

Source of Funding

Pre-seed funding, the initial financial boost for startups, typically originates from close connections such as founders, friends, or family. At this early stage, the goal is to validate the business concept, create a prototype, or conduct initial market research.

Funding amounts are relatively modest, and the emphasis is on proving the idea’s viability before seeking more significant investments. Seed funding marks the next phase, where startups with a functioning product or service seek more significant investments for expansion.

Unlike pre-seed, this funding often comes from angel investors, venture capitalists, or early-stage funds. Investors at this stage look for evidence of market traction, user engagement, and a viable business model. Seed funding allows startups to scale operations, invest in marketing, and solidify their position in the market, paving the way for further growth and development.

Business Validation

Business validation is essential at the pre-seed and seed funding stages, but the focus and goals differ. With pre-seed funds, the goal is to show that the idea can work. Showing that there is a real need for the product or service is part of this.

Investors are often more willing to take chances at this point because they know the idea is still young. For seed capital, on the other hand, the business needs to be more solidified. Startups that want seed funding have to show that there is a need in the market, that they have users, and that they have a good business plan.

In the seed stage, investors want proof that the idea solves a problem and can work on a larger scale. Pre-seed funding checks to see if the idea is good, while seed funding checks to see if the business plan works and has room to grow.

Company Valuation

Company value is a very important part of getting funding for a startup, and it changes a lot between the pre-seed and seed funding stages. When an idea is just starting out and pre-seed funding is being considered, valuations are usually cheaper.

Investors know that ideas that haven’t been tested come with higher risks, so they spend less money to help show the business idea. As a company gets seed funding, its value tends to increase as it shows that its product or service works and that people want it. Investors are interested because the business has a better chance of growing, and the business plan has been used before.

The rise in value shows how far the company has come, how the market has responded, and how ready it is to grow. Understanding this change in value is very important for entrepreneurs because it helps them set realistic goals at every stage of their business’s growth.

Use of Funds

When startups are trying to get money, the way the money is used is very different between the pre-seed and seed funding stages. With pre-seed capital, the focus is on getting the business off the ground.

These funds are usually used for important things like making the first sample, doing market research, and ensuring the idea will work. It’s about making ideas tangible and ready to be tested. While seed funding, on the other hand, marks the start of a more advanced step. Once a product or service works, the focus changes to growing the business and getting a foothold in the market.

Seed cash is usually used to hire more people for the team, do more marketing, and make operations run more smoothly so the business can grow. It’s a critical stage where the work started with pre-seed funds comes together to make the business more complete and ready for the market. By knowing these differences, business owners can better match their funding needs to the needs of each stage of growth.

Investor Involvement

Investors are often more involved during pre-seed funding. Entrepreneurs who are just starting to work on their ideas can get help and advice from them. Investors often do more than just give money; they also give helpful information and suggestions that help shape the business.

Investors are more prominent when a company reaches the seed funding stage. Seed investors still want the business to succeed but usually want to be more significant in planning how it will do. They usually bring knowledge and contacts from the industry to help the startup grow quickly.

Although they aren’t as involved as they were in the pre-seed stage, seed investors are still very much involved in the growth of the business, using their knowledge to help the company deal with problems and take advantage of chances. When a business goes from pre-seed funding to seed funding, investors change their role from providing basic advice to becoming a strategic partner.

Risk Tolerance

The idea of risk tolerance is a key part of telling the difference between pre-seed funding and seed funding in the fast-paced world of startup funding. Investors are more willing to take risks during pre-seed funding because they are backing ideas and concepts that are still in their early stages.

This stage is marked by business models and prototypes that haven’t been tested yet, which is a sign of the underlying uncertainty. When a startup gets seed funds, people are less willing to take risks. At this point, investors want to see proof that the market will accept the product, that users will start to use it, and that the business plan will work.

The change comes from needing more concrete proof that the startup can make its ideas into a business that can last. Entrepreneurs need to understand these differences because they affect how they present their business to possible investors and show how important it is to match the funding steps with the amount of risk investors are willing to take.

| Aspect | Pre-Seed Funding | Seed Funding |

| Stage of Funding | Initiated when the idea is forming, often pre-prototype | Occurs when a product or service is developed and functional |

| Investment Size | Smaller investments for idea testing and prototyping | Larger investments for business growth and market expansion |

| Source of Funding | Often from founders, friends, or family | From angel investors, venture capitalists, or early-stage funds |

| Business Validation | Focus on proving the viability of the idea | Requires proof of market need, user engagement, and a viable business model |

| Company Valuation | Typically lower as it involves untested ideas | Tends to increase as the business demonstrates product success |

| Use of Funds | Used to make the idea tangible and ready for testing | Used for hiring, marketing, and scaling operations |

| Investor Involvement | Investors more involved in shaping the business | Investors provide strategic advice and industry contacts |

| Risk Tolerance | Higher tolerance for risk as ideas are untested | Lower tolerance, seeking proof of market acceptance and viability |

Final Thought

Pre-seed and seed funding are early-stage investment rounds, but their timing and purpose differ. Pre-seed funding occurs at the concept or idea stage, providing initial capital for market research and product development. Seed funding comes after, supporting businesses with a validated concept and a prototype. In simple terms, pre-seed is the seed of an idea, while the seed is nurturing that idea into a budding business.